Hello and welcome to exampundit. Today we are sharing all about the MUDRA Bank and MUDRA Yojana launched by our Union Government. This article covers the purpose, features, functions and all the other important information on PM MUDRA Yojana and MUDRA Bank.

Pradhan Mantri MUDRA Yojana

The Pradhan Mantri MUDRA Yojana

(PMMY) is a scheme launched by the Union Government on April 8, 2015 for

providing loans upto ₹ 10

lakh to the non-corporate, non-farm small/micro enterprises.

(PMMY) is a scheme launched by the Union Government on April 8, 2015 for

providing loans upto ₹ 10

lakh to the non-corporate, non-farm small/micro enterprises.

Under PMMY, all banks viz. Public

Sector banks, Private Sector Banks, Regional Rural Banks (RRBs), State

Co-operative Banks, Urban Co-operative Banks, Foreign Banks and Non-Banking

Finance Companies (NBFCs)/Micro Finance Institutions (MFIs) – are required to

lend to non-farm sector income generating activities below ₹10 lakh.

Sector banks, Private Sector Banks, Regional Rural Banks (RRBs), State

Co-operative Banks, Urban Co-operative Banks, Foreign Banks and Non-Banking

Finance Companies (NBFCs)/Micro Finance Institutions (MFIs) – are required to

lend to non-farm sector income generating activities below ₹10 lakh.

These loans are classified as

MUDRA loans under PMMY.

MUDRA loans under PMMY.

PMMY was announced through Union

Budget 2015-16, which proposed to create

MUDRA bank with a corpus of ₹ 20,000 crore made available

from the shortfalls of priority sector lending, to refinance Micro-Finance

Institutions through Pradhan Mantri Mudra Yojana.

Budget 2015-16, which proposed to create

MUDRA bank with a corpus of ₹ 20,000 crore made available

from the shortfalls of priority sector lending, to refinance Micro-Finance

Institutions through Pradhan Mantri Mudra Yojana.

Further, budget supported a credit guarantee corpus of ₹3,000 crore for

guaranteeing loans being provided to the micro enterprises.

guaranteeing loans being provided to the micro enterprises.

The purpose of PMMY is to provide funding to the non-corporate small

business sector. Non- Corporate Small Business Segment (NCSBS) consists of

millions of proprietorship/ partnership firms running as small manufacturing

units, service sector units, shopkeepers, fruits/ vegetable vendors, truck

operators, food-service units, repair shops, machine operators, small

industries, artisans, food processors and others, in rural and urban areas.

business sector. Non- Corporate Small Business Segment (NCSBS) consists of

millions of proprietorship/ partnership firms running as small manufacturing

units, service sector units, shopkeepers, fruits/ vegetable vendors, truck

operators, food-service units, repair shops, machine operators, small

industries, artisans, food processors and others, in rural and urban areas.

One of the biggest hurdles to the

growth of entrepreneurship in the Non-Corporate Small Business Sector (NCSBS)

is lack of financial support to this sector and a vast majority belonging to

this sector do not have access to formal sources of finance.

growth of entrepreneurship in the Non-Corporate Small Business Sector (NCSBS)

is lack of financial support to this sector and a vast majority belonging to

this sector do not have access to formal sources of finance.

Loan offerings under PMMY

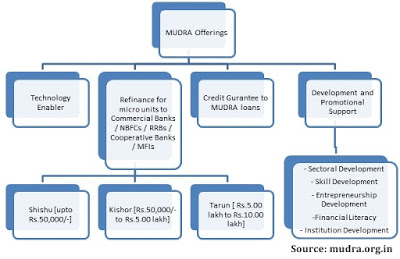

Under the aegis of PMMY, the

MUDRA has already created its initial set of products/ schemes. The interventions have been named ‘Shishu’

(meaning infant), ‘Kishor’ (meaning

child) and ‘Tarun’ (meaning

adolescent) to signify the state of growth/development and funding needs of the

beneficiary micro unit/entrepreneur and also provide a reference point for the

next phase of graduation / growth to look forward to:

MUDRA has already created its initial set of products/ schemes. The interventions have been named ‘Shishu’

(meaning infant), ‘Kishor’ (meaning

child) and ‘Tarun’ (meaning

adolescent) to signify the state of growth/development and funding needs of the

beneficiary micro unit/entrepreneur and also provide a reference point for the

next phase of graduation / growth to look forward to:

- Shishu: covering loans upto ₹

50,000/- provided with no collateral, @1% rate of interest/month repayable over

a period of 5 years - Kishor: covering loans above ₹50,000/-

and upto ₹ 5 lakh - Tarun: covering loans above

₹ 5 lakh to ₹ 10 lakh

Approach of PMMY

A minimum of 60% of support would flow to enterprises in the smallest

segment. Partner intermediaries of MUDRA Bank have to endeavor to adhere to

the following broad framework :

segment. Partner intermediaries of MUDRA Bank have to endeavor to adhere to

the following broad framework :

First time entrepreneurs, youth entrepreneurs (i.e. entrepreneurs

aged up to 30 years) and women entrepreneurs shall be encouraged and special

schemes shall be designed for such entrepreneurs,

aged up to 30 years) and women entrepreneurs shall be encouraged and special

schemes shall be designed for such entrepreneurs,

Emphasis shall be on cash flow

based lending and not security based lending. Collateral securities, etc. shall

be avoided.

based lending and not security based lending. Collateral securities, etc. shall

be avoided.

Repayment obligations shall be

flexible and shall be framed keeping in view the business cash flows of the

entrepreneur.

flexible and shall be framed keeping in view the business cash flows of the

entrepreneur.

Micro Units Development Refinance Agency (MUDRA) Bank

Micro Units Development Refinance

Agency (MUDRA) Bank is a refinance institution for micro-finance institutions.

As on date, MUDRA is conceived not only as a refinance institution and but also

as a regulator for the micro finance institutions (MFIs).

Agency (MUDRA) Bank is a refinance institution for micro-finance institutions.

As on date, MUDRA is conceived not only as a refinance institution and but also

as a regulator for the micro finance institutions (MFIs).

Key Persons:

- Kshatrapati Shivaji – Chairman of MUDRA Bank

- Pankaj Jain – Government Nominee Director

The MUDRA Bank is primarily be responsible for –

- Laying down

policy guidelines for micro/small enterprise financing business - Registration

of MFI entities - Regulation of

MFI entities - Accreditation

/rating of MFI entities - Laying down

responsible financing practices to ward off indebtedness and ensure proper

client protection principles and methods of recovery - Development of

standardized set of covenants governing last mile lending to micro/small

enterprises - Promoting

right technology solutions for the last mile - Formulating

and running a Credit Guarantee scheme for providing guarantees to the loans

which are being extended to micro enterprises - Creating a

good architecture of Last Mile Credit Delivery to micro businesses under the

scheme of Pradhan Mantri Mudra Yojana.

Government has decided to provide

an additional fund of ₹1

trillion (US$15 billion) to the market and will be allocated as

an additional fund of ₹1

trillion (US$15 billion) to the market and will be allocated as

- 40% to shishu

- 35% to kishor

- 25% to Tarun

Those eligible to borrow from MUDRA bank are

- small manufacturing units,

- service sector units,

- shopkeepers,

- fruits/ vegetable vendors,

- truck operators,

- food-service units,

- repair shops,

- machine operators,

- small industries,

- artisans,

- food processors

MUDRA Card is an innovative product which provides working capital facility as a cash credit

arrangement. MUDRA Card is a debit card issued against the MUDRA loan

account, for working capital portion of the loan. The borrower can make use of

MUDRA Card in multiple withdrawal and credit, so as to manage the working

capital limit in a most efficient manner and keep the interest burden minimum.

MUDRA Card will also help in digitalization of MUDRA transactions and creating

credit history for the borrower.

arrangement. MUDRA Card is a debit card issued against the MUDRA loan

account, for working capital portion of the loan. The borrower can make use of

MUDRA Card in multiple withdrawal and credit, so as to manage the working

capital limit in a most efficient manner and keep the interest burden minimum.

MUDRA Card will also help in digitalization of MUDRA transactions and creating

credit history for the borrower.

Sponsored

(adsbygoogle = window.adsbygoogle || []).push({});

Regards

Team ExamPundit