Hello and welcome to exampundit. Here is a set of High Level Data Interpretation for Syndicate Bank PGDBF 2017.

Answers:

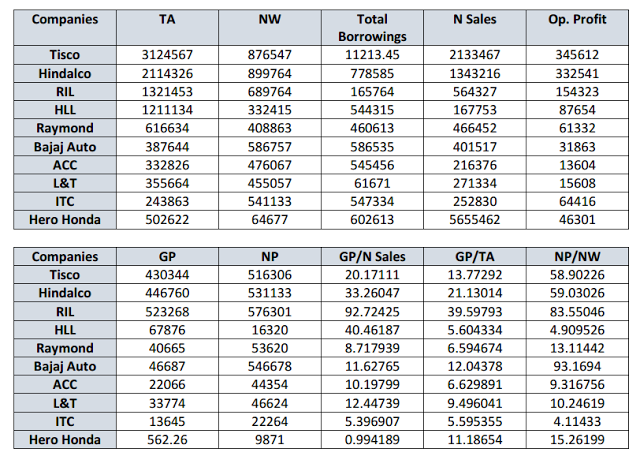

[Directions: Set of 5

Questions] The table shows the financial performances of ten companies for

a particular year

Questions] The table shows the financial performances of ten companies for

a particular year

NP = Net Profits NW

= Net Worth GP = Gross

Profits TA = Total Assets

= Net Worth GP = Gross

Profits TA = Total Assets

N Sales = Net Sales

Q1. If NP/NW ratio is considered to be an index of

performance, then which of the companies is the best performer?

performance, then which of the companies is the best performer?

(1) Tisco

(2) Raymond

(3) Bajaj Auto

(4) Hero Honda

(5) ITC

Q 2. Highest profit on sales has been achieved by

(1) RIL

(2) HLL

(3) ITC

(4) Hindalco

(5) Raymond

Q 3. If executive compensation is a foundation of only net

profit on sales, then which organisations could be expected to be most

remunerative for an executive?

profit on sales, then which organisations could be expected to be most

remunerative for an executive?

(1) RIL

(2) Bajaj Auto

(3) Hero Honda

(4) Raymond

(5) None of these

Q 4. If returns on investment is a function of only net

profit over net worth, then which company should a person invest in?

profit over net worth, then which company should a person invest in?

(1) Tisco

(2) HLL

(3) RIL

(4) Bajaj auto

(5) None of these

Q 5. Which one of the groups could be termed as lean as thin

(in the context of Total Assets) as well as performing better in terms of

profits as compared to Bajaj Auto?

(in the context of Total Assets) as well as performing better in terms of

profits as compared to Bajaj Auto?

(1) ITC

(2) HLL

(3) Hero Honda

(4) Can’t Say

(5) None of these

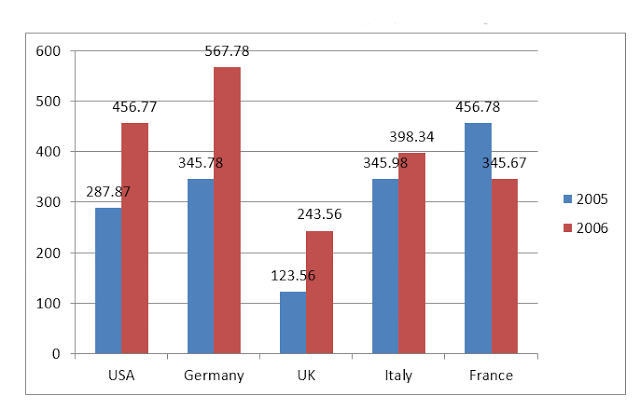

[Directions: Set of 5

Questions] The bar graph shows the

export of silk goods(in crore rupees) by different countries in the years 2005 and 2006:

Questions] The bar graph shows the

export of silk goods(in crore rupees) by different countries in the years 2005 and 2006:

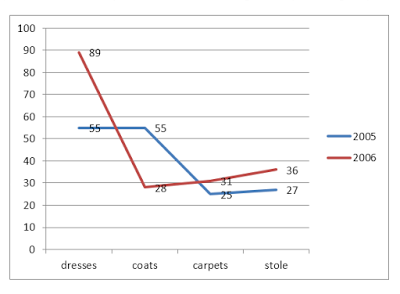

The line graph shows

the breakup of cost of different silk goods in percentage exported by France

the breakup of cost of different silk goods in percentage exported by France

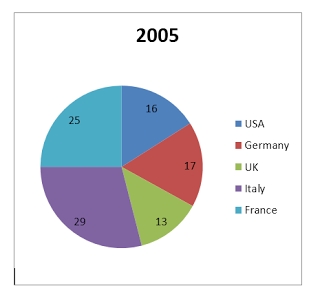

The pie chart shows

the percentage of tax paid per crore on exports by different countries in 2005

the percentage of tax paid per crore on exports by different countries in 2005

6. The total cost of dresses exported by France in 2005 is

how many times of the carpets exported by France in 2006?

how many times of the carpets exported by France in 2006?

(1) 1.34

(2) 0.34

(3) 2.34

(4) 3.34

(5) 5.34

7. The average of silk exports in 2005 is what percent of

the average export in 2006?

the average export in 2006?

(1) 87.53

(2) 77.53

(3) 56.36

(4) 98.36

(5) None

8. Who pays the maximum tax?

(1) USA

(2) Germany

(3) Italy

(4) UK

(5) France

9. The tax paid by Germany is how much percent less than the

cost of silk stoles exported by France in 2005.

cost of silk stoles exported by France in 2005.

(1) 42.33

(2) 52.33

(3) 65.25

(4) 78.36

(5) None

10. The average of the exports of silk in 2006 by the 5 countries is :

(1) 402.42

(2) 523.36

(3) 502.36

(4) 325.25

(5) None

Answers:

- 3

- 1

- 2

- 4

- 3

- 3

- 2

- 5

- 2

- 1

Detailed Solutions:

1. The ratio NP/NW is highest for Bajaj Auto, so it is the best performer.

2. From the column of net profits of the companies, we can easily conclude that RIL has the highest profit

3. You don’t need to check net profit on sales for all the companies. B taking a sharp view of the table, you will get that only for two companies:

RIL = 576301/564327 = 1.021

And, Bajaj Auto = 546678/401517 = 1.361 So, Bajaj Auto is your answer

4. From the table. It is clear that net profit over net worth is maximum for Bajaj Auto. So, a person should invest in Bajaj Auto

5. B taking a sharp view of the given table, you will find that Hero Honda satisfied both the conditions

6. 0.55*456.78/ 0.31*345.67 =251.229/107.16=2.34

7. 2005 average=311.99

2006 average=402.42

Ans-311.99/402.42*100=77.53

8. USA=0.16*287.87=46.05

Germany=0.17*345.78=58.78

Italy=0.29*345.98=100.33

UK=0.13*123.56=16.06

France=0.25*456.78=114.195

9. Germany=0.17*345.78=58.78

silk stoles exported by France in 2005.=0.27*456.78=123.33

123.33-58.78/123.33*100=52.33%

Sponsored

(adsbygoogle = window.adsbygoogle || []).push({});

Regards

Team ExamPundit