Hello and welcome to ExamPundit. Here are the Important Current Affairs for 14th May, 2015. Now, if you see, today’s most important news is that RBI relaxed 2-factor authentication.

On the other hand Modi ji’s China Visit, SBI’s Contactless Card launch is also important. Another Important news is the WPI Inflation. United Nation’s Predictions are always important. Finally we will get to see India vs Pakistan.

As SBI PO and IBPS PO is coming close, we will be providing a preface on a regular basis.

On the other hand Modi ji’s China Visit, SBI’s Contactless Card launch is also important. Another Important news is the WPI Inflation. United Nation’s Predictions are always important. Finally we will get to see India vs Pakistan.

As SBI PO and IBPS PO is coming close, we will be providing a preface on a regular basis.

Finance/Economy/Banking/RBI

–

–

RBI relaxes 2-factor

authentication for payments up to Rs. 2,000

authentication for payments up to Rs. 2,000

- Now, make payments up to Rs. 2,000 without punching your

password at any retail outlet or while shopping online. - Waiving the second or the additional factor of

authentication (AFA) on small value transactions, RBI on Thursday released

final guidelines for the same to enhance the convenience factor facilitating

easy online and contact-less card payments. - This will help consumers shopping online on e-commerce

websites in faster payments skipping the process of typing an additional

password while making small value payments. One can also avoid swiping cards at

retail outlets and instead just tap or waive to the card reading machines. - “After examining the trade-off between security and

convenience in card transactions, Reserve Bank had placed for public comments a

draft circular outlining the relaxation in the need for AFA in case of small

value card present transactions using Near Field Communication (NFC)

contactless technology subject to adherence to EMV standards. - “Relaxation for AFA requirement is permitted for

transactions for a maximum value of Rs. 2,000 per transaction…across all

categories of merchants in the country where such contact-less payments will be

accepted,” RBI said in a notification. - It added that beyond Rs. 2,000, the card has to be processed

as a contact payment and authentication with PIN (AFA) will be mandatory.

However, customers cannot be compelled to do a contact-less payment. - For cards without the NFC technology, “even for transaction

values below this limit, the customer may choose to make payment as a contact

payment”, which has to be facilitated by all banks and clearly tell the customer

about the same, RBI said.

SBI launches

contactless card payment tech

contactless card payment tech

- State Bank of India (SBI), India’s largest bank, has

introduced contactless card payments technology that allows payments by waving

or tapping of the cards near the machines. - “The bank, and its credit card subsidiary – SBI Card – have

launched the sbiINTOUCH Contactless Debit Card and SBI Signature Contactless

Credit Card for quick, secure and hassle-free payments at merchant outlets.

Contactless cards use the near-field communication (NFC) technology, enabling

users to make payments by waving or tapping the card near the contactless

reader instead of swiping or dipping it,” SBI said in a statement. - At present, customers can make payments up to Rs. 2,000 per

tap and pay transactions at select point-of-sale (POS) machines. Reducing the

risk of card loss and fraud, the customers can tap or wave the card at the POS

machine, enter the pin, and complete the payment transaction at busy locations,

the bank said. - Contactless cards are designed to replace the use of cash in

busy retail environments such as supermarkets, convenience stores, petrol

stations and quick-service restaurants. - At present, SBI has about 5,000 such NFC-enabled POS

machines in major cities such as Mumbai, Delhi, Chennai, Kolkata, Pune,

Ahmedabad and Bengaluru. The bank plans to further increase the number of POS

machines to 1 lakh and convert existing machines into NFC-enabled. - The bank has 2.20 lakh POS machines across the country.

WPI inflation dips to

record (-)2.65% in April

record (-)2.65% in April

- Deflationary pressure continued for the sixth month in a row

with inflation dropping to a new low of 2.65 per cent in April, mainly on

account of decline in prices of fuel and manufactured items even as food prices

increased. - Inflation, as measured on the Wholesale Price Index (WPI),

has been in the negative zone since November, 2014. In April last year, it was

5.55 per cent. - The deflationary trend has bolstered the case for a rate cut

by the Reserve Bank, as retail inflation has also eased and industrial

production is down, experts said. Industrial output had slowed to 5-month low

of 2.1 per cent in March. - Inflation was 2.33 per cent in March, 2.17 per cent in

February, 0.95 per cent in January, 0.50 per cent in December and 0.17 per cent

in November. - In April this year, the manufactured products segment

witnessed deflation for the second consecutive month as prices dropped to a

record low of 0.52 per cent. - Inflation in food articles category stood at 5.73 per cent,

from 6.31 per cent in March. For fuel and power, it was 13.03 per cent in

April.

India to Grow at 8.1%

in 2015-16: UN Report

in 2015-16: UN Report

- Indian economy is likely to clock 8.1 per cent growth in the

current financial year, spurred by strong consumer spending amid low inflation,

infrastructure projects and government’s reform measures, says a UN report. - Investment is also expected to rebound, although unevenly,

given the still low capacity-utilisation rate at about 70 per cent, it said. - It said however that volatile capital flows that may follow

monetary policy normalisation in the US remain the downside risk. - The growth projection is in line with the estimates of the

Finance Ministry. - The International Monetary Fund (IMF) and the World Bank

have projected India’s growth at 7.5 per cent for the current fiscal. However,

the Reserve Bank of India (RBI) has forecast a growth rate of 7.8 per cent. - The report said, decline in inflation benefits from lower

global energy prices, but structural factors that keep food prices remain high.

CCEA gave its

approval for 5% disinvestment in NTPC and 10% in Indian Oil Corporation

approval for 5% disinvestment in NTPC and 10% in Indian Oil Corporation

- The Cabinet Committee on Economic Affairs (CCEA) on 13 May

2015 gave its approval for 5 percent disinvestment in National Thermal Power

Corporation Limited (NTPC) and 10 percent disinvestment in Indian Oil

Corporation (IOC). - Disinvestment in these two Maharatna companies will fetch

government over 13000 crore rupees at current market price. The proposed share

sale of 5 percent in NTPC will fetch Union government 5600 crore rupees while

that of 10 percent in IOC will bring in 8100 crore rupees. - Currently, Union Government holds 74.96 percent stake in

NTPC and 68.57 percent stake in IOC. After the sale, the Government will be

left with a 58.57 percent stake in Indian Oil and 69.96 percent in NTPC.

Benami Transactions

(Prohibition) (Amendment) Bill, 2015 introduced in Lok Sabha

(Prohibition) (Amendment) Bill, 2015 introduced in Lok Sabha

- The Benami Transactions (Prohibition) (Amendment) Bill, 2015

was on 13 May 2015 introduced in Lok Sabha after Union Cabinet gave its

approval to amend the Benami Transactions (Prohibition) Act, 1988. - The Bill seeks to amend the Benami Transactions

(Prohibition) Act, 1988 by adding additional provisions that provides for

stringent measures against violators in order to curb and check the generation

of black money in the country. - It adds provisions for attachment and confiscation of benami

properties and imposes fine with imprisonment. It has provision for prosecution

and aims to act as a major avenue for blocking benami property, which leads to

generation and holding of black money especially in real estate.

Canara Banks signs MoU

with Volvo-Eicher for vocational education loans

with Volvo-Eicher for vocational education loans

- Canara Bank, a public sector bank, has signed a Memorandum

of Understanding (MoU) with Volvo-Eicher Commercial Vehicles Ltd (VECV) for

financing vocational education loans. - The MoU was signed by S Ramesh, General Manager, Canara

Bank, on behalf of PC&FI Wing and Shyam Maller, Senior Vice-President,

Sales, Marketing and After Market, on behalf of Volvo-Eicher Commercial

Vehicles Ltd.

PM

Visit to Three Nation (China, Mongolia & South Korea) –

Visit to Three Nation (China, Mongolia & South Korea) –

PM Narendra Modi

arrives in China

arrives in China

- Prime Minister Narendra Modi on Thursday arrived on a

three-day visit to China during which he will hold summit talks with Chinese

President Xi Jinping on a range of issues including the festering border

dispute and China’s plans for infrastructure projects in Pakistan—occupied

Kashmir (PoK). - Mr. Modi, who is undertaking his first visit to China as

Prime Minister, would begin his day with a visit to the famous Terracotta

Warriors museum which has a large collection of terracotta sculptures depicting

the armies of Qin Shi Huang, the first Emperor of China. - He would later visit the famous Buddhist Dashang temple in

Shaanxi province, the home province of President Xi, who has restored its old

glory by making it the headquarters of his mega Silk Road projects. - He is being accompanied by National Security Advisor Ajit

Doval, Foreign Secretary S Jaishankar and senior officials. - China is the first leg of Modi’s three—nation tour that will

also take him to Mongolia and South Korea.

India

–

–

Punjab became the

first state in India to issue Soil Health Cards to farmers

first state in India to issue Soil Health Cards to farmers

- Punjab Agriculture Department on 13 May 2015 launched a

pan-state programme to monitor the soil health of every farm in the state by

issuing them personalised Soil Health Cards (SHCs). With this, Punjab became

the first state in India to issue Soil Health Cards to farmers. - In this regard, every district of state was assigned a

mobile soil testing lab. These labs will take soil sample from every farm and

will issue digitalised soil health details. - As per Punjab Government, it is mandatory for Soil Testing

Labs to check soil health quarterly.

Each health card holder will be issued a written advisory on usage of

fertilisers and seeds adaptability.

Sports

–

–

BCCI and PCB signs

MoU for 5 Bilateral Series Between India and Pakistan

MoU for 5 Bilateral Series Between India and Pakistan

- The Government of India on Wednesday approved resumption of

cricket ties with Pakistan, after the Pakistan Cricket Board (PCB) chief

Shahryar Khan met Finance Minister Arun Jaitley. - The government reportedly does not have any issues with

Indo-Pak cricket series, the first of which may be hosted by Pakistan at their

‘adopted’ home UAE since the security situation in Pakistan is not ideal to

host India. But there is no final decision on this yet. - The two boards have signed a Memorandum of Understanding

(MoU) for five bilateral series over eight years. - India had cut all cricketing ties with Pakistan since the

26/11 Mumbai attacks; however, India did host Pakistan for an ODI series in

2011. - Zakir Khan, PCB’s Director of cricket operations, said, Good

for Pakistan cricket. Shahryar is in India and pushing for the series. It’s a

personal victory for him. - Since 2007, India and Pakistan haven’t been involved in a

full-fledged tour, largely due to political reasons.

Tejaswini bags gold

in under-15 World School Chess Championship

in under-15 World School Chess Championship

- Talented Indian youngster Tejaswini Sagar won her maiden

world title bagging the gold in the under-15 category of World School Chess

Championship that concluded here today. - Needing a last round win and one favourable result, the Aurangabad-girl

defeated Kavinya Miyuni Rajapaksa of Sri Lanka in the ninth and final round. - Tejaswini was aided by the result on the top board as

overnight leader Irina Barbayeva of Russia lost to Alisa Kozybayeva of

Kazakhstan in the final clash. - For the record, Tejaswini scored seven points out of a

possible nine, winning six, drawing two and losing one game. - Her defeat came earlier in the championship against

compatriot Isha Sharma when the champion fell under an opening trap but in

other games, Tejaswini was above par.

World

–

–

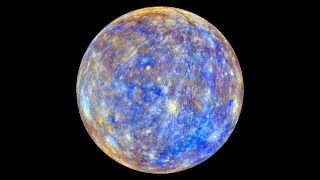

Indian wins NASA

contest to name Mercury crater

contest to name Mercury crater

- Enheduanna, the name suggested by an Indian space

enthusiast, is one of the winners of a NASA contest to name five new craters on

Mercury. - The five winning names for the craters are: Enheduanna, Carolan,

Karsh, Kulthum and Rivera. - Enheduanna, suggested by Gagan Toor from India, is a

princess of the Sumerian city of Ur in ancient Mesopotamia (modern Iraq and

Kuwait). She is the first known poet and author. - The names were selected by the public outreach team for the

spacecraft out of thousands of submissions to an open competition that closed

in January, ‘Space.com’ reported. - The new crater names have been approved by the International

Astronomical Union (IAU). - The rules of the IAU state that Mercury features must be

named after an artist, composer or writer who was famous for more than 50 years

and died at least three years ago.

India Honoured for

Significant Contribution to UN Peacekeeping

Significant Contribution to UN Peacekeeping

- India which has contributed nearly 180,000 troops, the

largest by any country, to the UN peacekeeping operations has been honoured for

making significant contribution towards global peace and stability at the

Capitol Hill here. - The new Indian Ambassador to the US Arun K Singh received

the award in recognition of India’s commitment to peacekeeping at the event

organised by Better World Campaign, The United Nations Association of the USA

and the US-India Business Council. - Multi-dimensional peacekeeping is a contemporary reality and

there is a need to involve troop contributing countries in all aspects of

mission planning, Singh said in his address. - India has contributed nearly 180,000 troops, the largest

number from any country, participated in more than 44 missions out of the 69 UN

peacekeeping operations mandated so far and 158 Indian peacekeepers have made

the supreme sacrifice while serving in UN missions. - India has been among the largest troop contributors with

around 8000 personnel deployed with 10 UN Peacekeeping Missions this year,

including the first Female Formed Police Unit under the UN.

:: Download Today’s PDF ::

Regards

Team ExamPundit

Sponsored

(adsbygoogle = window.adsbygoogle || []).push({});

Books For 2015 Banking/Insurance Exams