(adsbygoogle = window.adsbygoogle || []).push({});

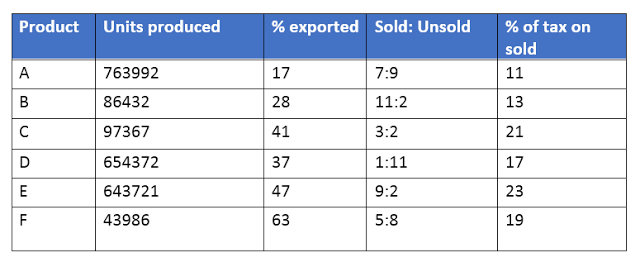

and F. A part of each product is exported and the remaining units are sold

inside the country. The table shows the units produced, the percentage of units

exported. The ratio of sold and unsold units of the part of products sold

inside the country along with the tax required to be paid by the company for

respective products is mentioned in the table. Now answer the following

questions as per the information provided.

1.What is the difference between the in-country tax paid by D and A?

a) Rs.8900

b) Rs.1300

c) Rs.8000

d) Rs.900

e) Rs.24676

2.Highest Tax on in country sold units is paid by which of the following:

a) A

b) F

c) D

d) C

e) A and C

3.If product E needs to pay 31 % tax on exported units. Find the total amount of tax paid by the company for product E in the whole year of 1990?

a) Rs.361890

b) Rs.784444

c) Rs.190988

d) Rs.67345

e) None of these

4.If the warehouse of the company stores only the in-country saleable unsold units of each product, then what is the relation between the current warehouse storage of product A and product C.

a) A is 27334 units larger than C

b) C’s storage is 2.14 % of A

c) C is 87.95 % less than A

d) Both a and b

e) Both b and c

5. If the government imposes an agricultural tax of 17% on the unsold units of the in-country saleable units of product D only, then the agricultural tax paid by the company for D is:

a) Rs.64243

b) Rs.23411

c) Rs.89788

d) Rs.90000

e) None of these

Answers:

units + Tax on export units

ep

Recommended Test Series

(adsbygoogle = window.adsbygoogle || []).push({});

Regards

Team ExamPundit

This post was last modified on June 2, 2019 12:12 pm