Finance /

Business / Economy

Business / Economy

1. RBI notified norms to set up TReDS trading

platform for MSME receivables

platform for MSME receivables

- ·

Reserve Bank of India (RBI) on 4 December 2014 notified norms to set up

Trade Receivables Discounting System (TReDS) trading platform for micro, small

and medium enterprises (MSME) receivables. - ·

TReDs is a scheme for setting up and operating the institutional

mechanism to facilitate the financing of bills of MSMEs from corporate and

other buyers, including government departments and public sector undertakings

(PSUs).

Norms notified by RBI

- ·

MSME sellers, corporate and other buyers, including the government departments

and PSUs, and financiers (both banks and NBFCs) will be direct participants in

the TReDS. - ·

The TReDS will provide the platform to bring these participants together

for facilitating uploading, accepting, discounting, trading and settlement of

the invoices or bills of MSMEs. - ·

The TReDS should have a minimum paid up equity capital of 25 crore

rupees and it will not allow any credit. - ·

Among all the entities only promoters will be permitted to have

shareholding in excess of 10 percent of the equity capital of the TReDS. - ·

The foreign shareholding in the TReDS would be as per the extant foreign

investment policy. - ·

TReDS should have sound technological basis to support its operations,

be able to provide electronic platform for all the participants and information

about bills, discounting and quotes should be in real time supported by a

robust information system. - ·

The TReDS shall have a suitable Business Continuity Plan (BCP) including

a disaster recovery site and shall have an online surveillance capability which

monitors positions, prices and volumes in real time so as to check system

manipulation.

2. RBI relaxed norms for PPIs and doubled the

limit to one lakh rupees

limit to one lakh rupees

- ·

The Reserve Bank of India (RBI) on 3 December 2014 relaxed the norms for

Pre-paid Payment Instruments (PPI) and doubled the limit of PPI from 50000

rupees to one lakh rupees. - ·

The move would help in achieving the objective of limiting cash

transactions in the system.

Highlights of RBI norms on PPI

- ·

The maximum validity of gift cards has been enhanced from one year to

three years. Other provisions of PPI guidelines with respect to gift cards will

continue. - ·

RBI also allowed issue of multiple PPIs by banks from fully-KYC

compliant bank accounts for dependent or family members. - ·

Only one card can be issued to one beneficiary. - ·

The bank may put in place mechanisms to monitor and report suspicious

transactions on these PPIs to Financial Intelligence Unit India (FIU-IND). - ·

The central bank also permitted banks to issue rupee denominated PPIs

for visiting foreign nationals and NRIs. - ·

However, this would be subject to certain conditions like the cards can

be issued by overseas branches of banks in India directly or it can be issued

by co-branding with the exchange houses/money transmitters up to a maximum

amount of 2 lakh rupees by loading from a KYC compliant bank account. - ·

Such PPIs should be activated by the bank only after the traveller

arrives in India and cash withdrawal will be restricted to 50000 rupees per

month. - ·

The cards should be issued strictly for use in India and transactions

should be settled in Indian rupee.

What is Prepaid payment instruments

Prepaid

payment instruments (PPIs) are those which facilitate purchase of goods and

services against the value stored on such instruments. The value stored on such

instruments represents the value paid for by the holder, by cash, by debit to a

bank account, or by credit card.

payment instruments (PPIs) are those which facilitate purchase of goods and

services against the value stored on such instruments. The value stored on such

instruments represents the value paid for by the holder, by cash, by debit to a

bank account, or by credit card.

3. Supreme Court directed Union to prosecute

black money hoarders abroad by 31 March 2015

black money hoarders abroad by 31 March 2015

- ·

The Supreme Court on 3 December 2014 directed the Union to complete

prosecution of black money hoarders abroad under the Income Tax Act, 1961 by 31

March 2015. - ·

A SC Bench comprising of Chief Justice of India H L Dattu, Justice Madan

B Lokur and Justice A K Sikri directed the Union and Special Investigation Team

(SIT) to probe the cases of black money. - ·

The court also said that if for any reasons the probe remains

inconclusive then appropriate decision will be taken by Union to extend the

deadline of 31 March 2015. - ·

The court also asked SIT head Justice M B Shah to consider the plea of

petitioner Ram Jethmalani to provide him the copies of the reports of SITs

probes into the black money cases without blackening the content. - ·

Earlier in October 2014, the Centre submitted to the Supreme Court a

list of 627 Indians holding black money in accounts abroad in HSBC bank,

Geneva. - ·

According to the amendment of Income Tax Act, 1961 recently, the period

of limitation for launching prosecution has been extended from six years to 16

years to enable the prosecution of black money hoarders.

4. HDFC Bank rules out a JV for payment bank

- ·

HDFC Bank has become the first in the sector to rule out a joint venture

partnership with any applicant for one of the proposed payment banks (PBs). - ·

In final guidelines issued last week, the Reserve Bank of India has

allowed entities to form an alliance with a lender to form a PB. The idea is

that PBs would tap unbanked areas and such an alliance would help. Puri said HDFC Bank was capable of tapping

far-flung areas on its own. Nor does he think they pose a worry on competition.

“There is enough for everyone to do. There is space for payment banks, small

banks, regional rural banks and large banks to exist,” he said. - ·

Analysts believe other large lenders might similarly not be keen on

partnering with either prepaid payment issuers (such as credit cards), telecom

companies or other such entities to form one of the niche banks for which RBI

would invite applications. - ·

An advisor with Indian Banks’ Association said large banks themselves

have an extensive branch network to cover under-banked regions. Plus, they run

the risk of a PB in which it takes a stake eating into the original business

over a period.

5. States may get power to tinker with ‘State

GST’ rates

GST’ rates

- ·

The Centre may allow States to unilaterally tinker with State-level

Goods and Services Tax (State GST) rates as part of its efforts to build a

consensus on the proposed dual-GST system in the country. In the GST

architecture proposed during the UPA regime, the Centre was to decide on the

rates in consultation with States. - ·

The main issue was that all the States had to follow the rates and there

was no room to unilaterally deviate from them. They had to go to the GST

Council to change the rates. - ·

India is looking to implement a dual-GST system, where the Centre will

impose a Central GST (CGST) and the States will impose a State GST (SGST). Over

150 countries have implemented GST. The proposed flexibility for States to

tinker with SGST rates could enable consensus on the GST implementation front,

official sources said. - ·

Indications are that States will be allowed to tinker with rates within

a specified band. Giving the States flexibility to set rates will provide a

“psychological boost” and may encourage them to move forward on dual GST

implementation, informed sources said. The Centre is now looking at a revenue

neutral rate (RNR) of 27 per cent. This is the rate when petroleum products are

included within the GST ambit. The erstwhile UPA regime had talked of a RNR of

16 per cent.

6. Reliance Industries signs pact with

Mexican firm for oil and gas hunt

Mexican firm for oil and gas hunt

- ·

Reliance Industries has signed an agreement with Mexican state-owned

company, Petroleos Mexicanos (PEMEX) for cooperation in upstream oil and gas

production as well as in refining business. - ·

As per the Memorandum of Understanding (MoU) “RIL will cooperate with

PEMEX for assessment of potential upstream oil and gas business opportunities

in Mexico and jointly evaluate value added opportunities in international markets,”

a company statement said. - ·

RIL and PEMEX will also share expertise and skills in the relevant areas

of oil and gas industry, including for deep—water oil and gas exploration and

production. - ·

“The MoU envisages sharing of RIL’s pioneering expertise in deep-water

development and best practices in East Coast of India and RIL’s experience in

shale gas in United States,” it said. - ·

RIL will also provide technical support and share experience with PEMEX

for refining value maximisation and other technical optimisation strategies. - ·

“RIL’s cooperation with PEMEX is in line with its growth strategy to

explore opportunities to expand its international asset base in regimes having

internationally attractive competitive terms.

7. ICICI Bank and HDFC Bank lowered Fixed

Deposits rates by 25 bsp and 50 bsp

Deposits rates by 25 bsp and 50 bsp

- ·

Two largest private banks of India ICICI Bank and HDFC Bank on 3

December 2014 decided to lower Fixed Deposit (FD) rates. - ·

ICICI Bank lowered its term deposit rates by 25 basis points (bsp) while

HDFC Bank lowered its interest rates by up to 50 bsp on various maturities. - ·

Following the revision, the highest rate offered by the HDFC bank is

8.75% on deposits above one year. HDFC Bank’s new fixed deposit rates are

applicable from first week of December 2014. - ·

The revised rate of ICICI bank will come into effect from 28 November

2014.

8. SBI cuts deposit rates by 0.25 per cent

- ·

Country’s largest lender State Bank of India (SBI) cut its deposit rates

for maturities of over one year by 0.25 per cent on Friday, making it the third

bank after private sector rivals, ICICI Bank and HDFC Bank, to reduce deposit

rates this week. - ·

The bank, which has already affected rate cuts in the short-term

maturities of up to a year in two moves over the past few months, today reduced

the rates for deposits of over one year. - ·

Under the revised pricing applicable from Monday, a deposit in the bank

for over one year but less than five years will fetch an interest of 8.50 per

cent as against the earlier 8.75 per cent. - ·

For deposits of five years and above, the rate has been reduced to 8.25 per

cent as against the earlier 8.50 per cent, the bank said in a filing to the

exchanges. - ·

The review is for retail deposits of under Rs 1 crore, the bank said. - ·

The move comes a day after two private sector banks announced cuts of up

to 0.50 per cent in maturities of up to one year. - ·

State-run IDBI Bank had also yesterday announced 0.50 per cent cut in

deposit rates for maturities starting from 6 months to 20 years.

India

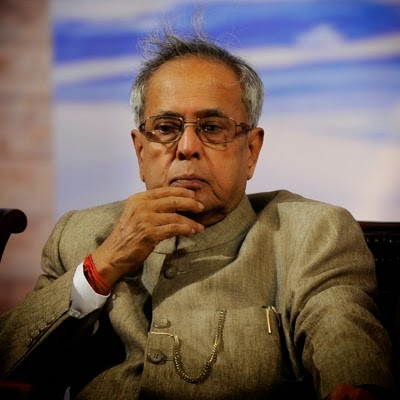

9. President Pranab Mukherjee inaugurated

Golden Jubilee Celebrations of Rama Devi Women’s College

Golden Jubilee Celebrations of Rama Devi Women’s College

- ·

President of India Pranab Mukherjee inaugurated Golden Jubilee

Celebrations of Rama Devi Women’s College on 30 November 2014 at Bhubaneswar,

Odisha. - ·

On this occasion, President paid tribute to the unique contribution and

leadership of Rama Devi. - ·

Rama Devi was one of the most committed workers in India’s national

movement and a devoted disciple of Mahatma Gandhi. - ·

She along with Gopabandhu Choudhury and Acharya Harihar Das organized

mass meetings in Odisha during the Civil Disobedience Movement in 1931. - ·

She led the Dandi March that took place on the West Coast of India in

1930. Inchudi on the Balasore Coast and Kujanga in Cuttack were selected by the

Utkal Provincial Congress Committee to break the Salt Law. - ·

She was an organiser, speaker, campaigner and inspirer of ordinary men

and women. She worked hard to root out untouchability and communalism. - ·

She organised a pada yatra to support Vinobha Bhave’s Bhoodan Movement

and gave utmost emphasis to education, emancipation and empowerment of women.

10. Subramanian Committee on Review of

Environmental Laws submitted report to the Union Government

Environmental Laws submitted report to the Union Government

- ·

High Level Committee on Review of Environmental Laws headed by former

Cabinet Secretary TSR Subramanian submitted its report to Union Ministry for

Environment, Forests and Climate Change on 18 November 2014. - ·

The committee recommended formulating a new umbrella law to streamline

the process of environment clearances for development projects in the country.

Main recommendations of the Committee

- ·

It proposed new Environment Loss Management Act (ELMA). - ·

It recommended full-time expert bodies, National Environment Management

Authority (NEMA) and State Environment Management Authority (SEMA), to be

constituted at the Central and state levels respectively. - ·

The NEMA and SEMA recommended to evaluate project clearance (using

technology and expertise), in a time bound manner, providing for single window

clearance. - ·

A fast track procedure for linear projects (roads, railways and

transmission lines), power and mining projects and for the projects of national

importance has been prescribed in the new mechanism. - ·

The committee has suggested amendments to almost all green laws,

including those relating to environment, forest, wildlife and coastal zone

clearances.

11. Air India and NBCC signed MoU for

Monetization of Land Assets

Monetization of Land Assets

- ·

Air India and National Buildings Construction Corporation Limited (NBCC)

on 4 December 2014 signed a Memorandum of Understanding (MoU) for

implementation of the monetisation of assets of Air India at various locations

on joint venture basis. - ·

The MoU was signed at Rajiv Gandhi Bhawan in New Delhi in the presence

of Union Urban Development Minister M Venkaiah Naidu and Civil Aviation

Minister Ashok Gajapati Raju. - ·

The MoU will be a non-binding, non-exclusive agreement and each land

asset will be individually evaluated for a particular mode of monetization

process. - ·

This MoU is intended to blend together NBCC’s huge expertise in

successful completion of several prestigious projects and Air India’s vast

surplus land assets.

Benefit of monetisation of assets

- ·

Monetisation of assets is important to any revival plan or Financial

Restructuring Plan (FRP) particularly for any loss making company. - ·

It will help in unlocking the value of unutilised immovable assets of

Air India by way of sale or lease of such assets - ·

This step will help it to bring more revenue making it less dependent on

the government for a bail out

- ü

CMD of Air India – Rohit Nandan and - ü

CMD of NBCC – Dr. Anoop Kumar Mittal

12. Union MoEF approved the construction of

Chhatrapati Shivaji Maharaj statue in Arabian Sea

Chhatrapati Shivaji Maharaj statue in Arabian Sea

- ·

The Union Ministry of Environment and Forests (MoEF) on 4 December 2014

gave its approval for the construction of Chhatrapati Shivaji Maharaj statue

and memorial in the Arabian Sea, off the Mumbai coast. - ·

As the project is environmentally sensitive, it will cost approximately

2000 crore rupees to ensure that it does not cause any environmental damage.

Highlights of the project

- ·

The proposal put forward by the state includes a 190-feet statue that is

to be erected on a rocky projection 1.5km from Raj Bhavan. The total area will

be 15.96 hectares. - ·

The plan is also comprised of three levels of pedestal with museums, art

galleries and recreation centres. - ·

On the mainland, there will be two jetties- the existing one at the

Gateway of India and a proposed jetty at Nariman Point to ferry passengers and

commodities. - ·

To make it environmentally sustainable, there will be a sewage treatment

plant and desalination plant along with wind mills, solar shelters, solar light

poles, tidal turbines etc. - ·

The memorial will consist of three layer pedestal of concrete with stone

cladding of granite. The rocky outcrop will be fortified with a Reinforced Cement

Concrete sea wall.

International

13. Indian-American scientist Arun Majumdar

appointed as US Science Envoy

appointed as US Science Envoy

- ·

Indian-American scientist Arun Majumdar was on 4 December 2014 appointed

as the United States (US) Science Envoy with effect from 1 January 2015. - ·

Arun Majumdar will join the office along with three other US Envoys

Peter Hotez, Jane Lubchenco and Geri Richmond. These distinguished scientists

will engage internationally at the citizen and government levels. - ·

They will work to develop partnerships, improve collaboration and forge

mutually beneficial relationships between other nations and the US. Their aim will

be to encourage improved scientific cooperation and promote economic

prosperity. - ·

Presently, Arun Majumdar is the Jay Precourt Professor at Stanford

University where he serves on the faculty of the Department of Mechanical

Engineering.

14. China to have world’s longest metro rail

network

network

- ·

China is expected to build 8,500 km of subway systems by 2020, giving it

the world’s longest metro rail network, the government said today. - ·

Nineteen cities have recently extended their metro systems, with total

mileage expected to hit 3,000 km by the end of the year, Chinese Minister of

Transport, Yang Chuantang was quoted as saying by state-run China Daily. - ·

Public transit, especially the subway, has had a major effect on easing

congestion in Beijing, and the government will inject more funding to promote

its development, Dai Junliang, deputy mayor of Beijing said. - ·

Four new subway lines will open to the public this month, which will

extend the capital’s subway to 527 km, the longest in the country. - ·

Daily ridership will increase gradually to more than 10 million, the

Beijing Commission of Transport said. - ·

Beijing has 26 professional emergency rescue teams with more than 500

members and holds more than 600 drills every year to sharpen capabilities in

dealing with emergencies, such as fire in a metro station or equipment

failures. - ·

In addition to frequent drills, Yang called for improved laws and

regulations to promote metro management and security.

15. North Korea bans use of leader’s name Kim

Jong Un

Jong Un

- ·

In North Korea, there can be only one Kim Jong Un. A South Korean

official said on Wednesday that Pyongyang forbids its people from using the

same name as the young absolute leader. - ·

The measure appears meant to bolster a personality cult surrounding Mr. Kim,

who took over after the death of his dictator father Kim Jong Il in late 2011.

Seoul officials have said Pyongyang also banned the use of the names of Kim

Jong Il and the country’s founder, Kim Il Sung. - ·

The South Korean official said Kim Jong Il in early 2011 ordered

citizens with the same name as his son to get new names and demanded that

authorities reject birth registrations of newborn babies with the name. - ·

The official requested anonymity because he wasn’t authorized to speak

publicly. He refused to disclose how the information was obtained. - ·

Mr. Kim Jong Un made his international debut in late 2010 when he was

awarded a slew of top political jobs. His father, who reportedly suffered a

stroke in 2008, was seen as moving fast to hand over power so his family could

rule for a third generation. - ·

Kim Jong Il inherited power in 1994 when his father Kim Il Sung died. - ·

North Korea enforces strict, state-organized public reverence of the Mr.

Kim family, which serves as the backbone of the family’s authoritarian rule of

the impoverished country. The North is locked in a long-running international

standoff over its nuclear ambitions.

Sports

16. Indian Oil won Beighton Cup Hockey

tournament

tournament

- ·

Indian Oil won the 119th Beighton Cup Hockey tournament on 4 December

2014. In the final match played at the SAI Eastern Centre in Kolkata the Indian

Oil defeated the Punjab National Bank in tie-breaker by 5-4 goals. - ·

The match ended in a draw at 2-2 goals at the schedule time of the game. - ·

The awards of the tournament were presented by the West Bengal Governor

Keshari Nath Tripathy. - ·

Beighton Cup is one of the oldest field hockey tournaments in the world

and running till date. It was instituted in 1895. It is organised by Bengal

Hockey Association - ·

The other one of the oldest Hockey tournaments of India is Aga Khan Cup.

It is held in Mumbai since 1896.

17. Raninder Singh became first Indian to be

elected to ISSF executive committee

elected to ISSF executive committee

- ·

Raninder Singh on 3 December 2014 became the first Indian to get elected

as a member of the International Shooting Sport Federation (ISSF)’s Executive

Committee. He is the President of National Rifle Association of India (NRAI). - ·

This is the first time in the 107-year history of ISSF that an Indian

has been elected as the member of the global body representing the sport of

shooting. - ·

Contesting his first election, Raninder garnered 22 out of 25 votes in

the General Assembly meeting held at Munich, Germany. - ·

He was also elected as the member of the Administrative Council of ISSF

with 145 out of 293 votes.