Hello and welcome to exampundit. IRDAI invites applications from eligible Indian citizens for filling up the post of Assistant Manager through open competition on all India basis for its various offices. Selection will be through a country-wide competitive Phase – I “On-line Preliminary Examination” followed by Phase – II “Descriptive Examination” at select centres and Interview.

Important Dates

- Website Link Open for on-line registration of applications- 15.8.2017

- Last date for on-line application and payment of examination fee/intimation charges – 5.9.2017

- Conduct of Phase – I On-line Preliminary Examination (Objective type) – 4.10.2017

Age Limit (as on 5.9.2017): Not below 21 years and not above 30 years as on 5.9.2017, i.e., candidates should have been born not earlier than 6.9.1987 and not later than 5.9.1996 (both days inclusive)

Educational Qualification: Graduation from a recognized University with minimum 60% marks.

(adsbygoogle = window.adsbygoogle || []).push({});

Vacancies:

- UR – 16

- OBC – 7

- SC – 4

- ST – 4

- Total – 30 Vacancies

Salary:

Selected candidates will draw a starting basic pay of Rs.28,150/- per month in the scale of Rs.28150-1550(4)-34350-1750(7)-46600-EB-1750(4)-53600-2000(1)-55600 (17 years) and other allowances, like Dearness Allowance, House Rent Allowance, City Compensatory Allowance, Grade Allowance, etc., as admissible from time to time. The candidates employed elsewhere and joining IRDAI will be fixed at the minimum of basic pay in the scale of pay applicable to the post.

At present, initial monthly gross emoluments for Assistant Manager is approximately Rs.81,000/-.

The following qualification allowances, in addition to the above, are applicable to candidates selected for posts with professional qualifications.

(adsbygoogle = window.adsbygoogle || []).push({});

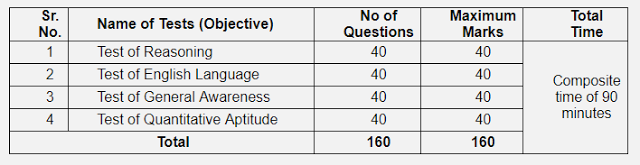

Phase – I

On-line Preliminary Examination (Objective Type). This is a qualifying examination to be eligible for Phase – II Descriptive Examination.

Through this, candidates for Actuarial, Accounts and Legal specializations and General vacancies will be shortlisted separately for Phase – II Descriptive Examination as per standards to be decided separately by IRDAI (approximately 20 times the number of vacancies subject to availability).

Marks secured in the Phase – I On-line Preliminary Examination will not count for interview or final selection.

Phase – II

Descriptive Examination comprising 3 Papers (Paper I, II and III) and

Phase – III Interview

Candidates for Actuarial, Accounts, Legal specializations and General vacancies will be shortlisted for Phase – III Interview based on the aggregate marks obtained in Papers I, II and III of Phase – II Descriptive Examination only. The minimum cut-off marks for being shortlisted for Phase – III Interview will be decided separately for each specialization and General vacancies by IRDAI.

Final selection will be based on the merit performance of the candidates under respective specialization in Phase – II Descriptive Examination and Phase – III Interview taken together.

Syllabus for Phase – II Descriptive Examination

(i) Paper I – English

a) Essay;

b) Precis writing;

c) Comprehension and Business/Office Correspondence.

(ii) Paper II – Economic and Social Issues impacting Insurance

a) Economic Growth, business cycles and Insurance penetration, impact of age structure on economy, application of utility theory to Insurance premium setting, macroeconomic factors including catastrophes and pandemics that may impact insurers and insurance markets;

b) Financial markets, Financial Institutions and financial services integration and risks arising from interconnectedness; systemic risk and concentration risk;

c) Economic capital and risk based capital requirements, economic impact of risk transfer arrangements including reinsurance, contribution of Insurance sector to sustainable and responsible development of economy, Insurance Investments in Infrastructure sector

d) Economic reforms in India leading to Insurance sector reforms, Insurance regulation – financial and market conduct regulations, functions of IRDAI, role of an Actuary, de-tariffing in India, motor business and Indian experience, changing Insurance Regulations/Laws and FSLRC.

e) Social structure in India, Insurance in rural and social sectors and obligations of Insurers thereto, Indian Micro-Insurance experience, Social security laws and implementation thereof. RSBY – Health insurance scheme for Below Poverty Line (BPL) families.

Click To Apply

- IBPS RRB Assistant 2017 – Free Mock Test

- IBPS PO & Clerk 2017 – Free Mock Test

- IBPS RRB Officer 2017 – Free Mock Test

- Paramount SSC CGL Sure Shot 2017- Free Mock Test

- SSC Stenographer 2017 – Free Mock Test

(adsbygoogle = window.adsbygoogle || []).push({});

Regards

Team ExamPundit