Hello and welcome to ExamPundit. Today we have prepared a Short Note on CTS-2010 STANDARD. It is very important for Banking PO and Clerical Exams and Interviews.

Definition

of Cheque Truncation:

of Cheque Truncation:

- Truncation is the process in which an issued cheque is not

moved physically from the drawer bank branch to the drawee bank branch. Instead

an electronic image of the cheque is sent to the drawee branch through the

clearing house along with relevant information like data on the MICR band, date

of presentation, presenting bank, etc. - Cheque truncation thus eliminates the requirement of physically moving

documents across bank branches except unavoidable circumstances. This

effectively eliminates the associated cost of movement of the physical cheques,

reduces the time required for their collection and brings elegance to the

entire activity of cheque processing. - RBI decided to prescribe certain benchmarks towards

achieving standardisation of cheques known as “CTS-2010 standard”,

specifications.

Role of NPCI:

- RBI has mandated NPCI to operationalise CTS. NPCI will act

as a Cheque Processing Centre (CPC) and will process electronic cheques and

images received from member banks

Mandatory features applicable:

- Paper: Paper

should have protection against alterations by having chemical sensitivity to

acids, alkalis, bleaches and solvents giving a visible result after a

fraudulent attack. CTS-2010 Standard paper should not glow under Ultra-Violet

(UV) light i.e., it should be UV dull. - Watermark: All

cheques shall carry a standardized watermark, with the words “CTS-INDIA”. It

should be oval in shape and diameter could be 2.6 to 3.0 cms. Each cheque must

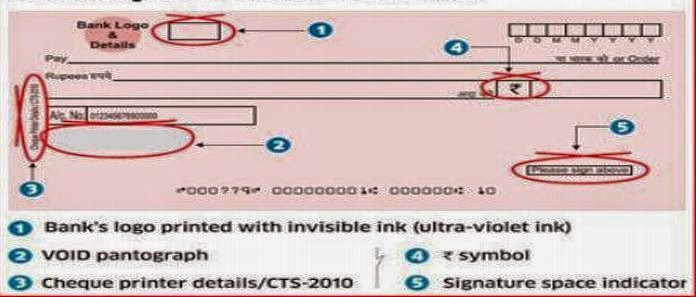

hold atleast one full watermark. - VOID pantograph:

Pantograph with hidden / embedded “COPY” or “VOID” feature shall be included in

the cheques. This feature should be clearly visible in photocopies and scanned

colour images as a deterrent against colour photocopy or scanned colour images

of a cheque. - Bank’s logo:

Member Bank’s logo shall be printed in ultraviolet (UV) ink. The logo will be

captured by / visible in UV-enabled scanners / lamps. It will establish

genuineness of a cheque. - Mandating colours and

background: Light / Pastel colours so that Print / Dynamic Contrast Ratio

(PCR / DCR) is more than 60% for ensuring better quality and content of images. - Prohibiting alterations

/ corrections on cheques: No changes / corrections should be carried out on

the CTS cheques (other than for date validation purposes, if required). For any

change in the payee’s name, courtesy amount or legal amount etc., fresh cheque

forms should be used by customers. This requirement is for cheques issued under

CTS only and no other cheques. - Printing of account field:

Cheques used in current accounts and corporate customers, should be issued with

the account number field pre-printed. Courtesy amount means amount in figures

and legal amount means in words.

Importance

of CTS:

of CTS:

- Speeds up the process of collection of cheques resulting in

better service to customers - Reduces the scope for clearing-related frauds or loss of

instruments in transit - Lowers the cost of collection of cheques

- Removes reconciliation-related and logistics-related

problems - The homogeneity in security features also act as a deterrent

against cheque frauds.

Clearing Methods:

- Speed Clearing is an arrangement to clear intercity non-at

par items. - Grid Clearing is an arrangement that allows banks to present/receive

cheques from/to multiple cities in a Single Clearing House through a service

branch at one city.

What

benefit does CTS provide to Bank’s Customers?

benefit does CTS provide to Bank’s Customers?

- It reduces the time taken to clear the cheques as well gives

banks to offer better customer services and increases operational efficiency by

decreasing on overheads involved in the physical cheque clearing process which

was used earlier. - It also provides better reconciliation and fraud prevention.

Source: RBI, IBA, Economic Times, Moneycontrol, The Hindu

Spread the word, share it with friends.

Regards

Team ExamPundit